MOTIVATION

Quote of the week

"The future belongs to those who believe in the beauty of their dreams."

-Eleanor Roosevelt-

Week of 01/07/2024

What You Need to Know This Week

The first half of the year ends with a dominance of technology stocks, with NASDAQ up 18.1% driven by excitement around AI, and SP500 up 14.5%, while the Dow only gained 3.8% (industrial).

All three indices have risen in 7 of the last 8 months.

Starting in 2026, crypto platforms will need to provide a 1099 form similar to traditional banks and brokers.

The FED anticipates at least one rate cut in 2024 but remains cautious, refraining from discussing it until more signs of disinflation appear.

The YEN has depreciated against the dollar, breaking the ¥161 level.

Transportation costs are rising, impacting inflation.

Data from Tuesday showed an unexpected increase in job openings, with both hiring and layoffs rising. There are now 1.2 jobs for every unemployed person, the lowest ratio since June 2021.

Powell has become more optimistic based on recent data.

Most hedge funds are underperforming compared to the SP500.

BTC ETFs saw a record inflow of $129M on July 1, with Fidelity's ETF recording $65M and $41M in a single day.

French regulators want to fine NVDA for anti-competitive practices.

Housing in the U.S. is becoming increasingly expensive.

The SP500 has risen 16% in the first 6 months of the year, and history suggests that the second half of an election year tends to be even better for equities.

BITWISE is seeking an ETH ETF.

U.S. factory orders fell by 0.5%, reversing the 0.4% increase in April, due to decreased demand for machinery and electrical equipment.

If you’re not subscribed to receive these emails weekly and completely free, you can do so with the button below:

ECONOMIC CALENDAR 08/07/2024

Economic Events

Time (NY) | Event | Influence |

|---|---|---|

Monday | 11:00 | |

CB Employment Trends Index (Jun) | Medium | |

12:00 | ||

New York Fed Consumer Inflation Expectations (1 Year) | High | |

16:00 | ||

Consumer Credit (May) | Medium | |

Tuesday | 07:00 | |

NFIB Small Business Optimism (Jun) | Medium | |

09:55 | ||

Redbook (YoY) | Medium | |

10:15 | ||

Speech by Supervisory Vice Chair Barr | High | |

12:00 | ||

Testimony by Fed Chair Powell | High | |

13:00 | ||

EIA Short-Term Energy Outlook | Medium | |

17:30 | ||

Weekly Crude Oil Inventories (API) | High | |

Wednesday | 08:00 | |

30-Year Mortgage Rate MBA | Medium | |

Mortgage Applications MBA (WoW) | Medium | |

11:00 | ||

Testimony by Fed Chair Powell | High | |

Wholesale Inventories (MoM) (May) | Medium | |

Wholesale Sales (MoM) (May) | Medium | |

11:30 | ||

EIA Crude Oil Inventories | High | |

12:00 | ||

Thomson Reuters IPSOS PCSI Index (Jul) | Medium | |

14:00 | ||

10-Year Notes Auction | Medium | |

Thursday | 09:30 | |

Continuing Jobless Claims | High | |

Core CPI (MoM) (Jun) | High | |

Core CPI (YoY) (Jun) | High | |

CPI (YoY) (Jun) | High | |

CPI (MoM) (Jun) | High | |

11:30 | ||

Natural Gas Storage | Medium | |

12:30 | ||

4-Week Treasury Bill Auction | Medium | |

12:30 | ||

8-Week Treasury Bill Auction | Medium | |

15:00 | ||

Federal Budget Balance (Jun) | High | |

Friday | 09:30 | |

Core PPI (MoM) (Jun) | High | |

Core PPI (YoY) (Jun) | High | |

PPI (MoM) (Jun) | High | |

PPI (YoY) (Jun) | High | |

11:00 | ||

Michigan 1-Year Inflation Expectations (Jul) | Medium | |

Michigan 5-Year Inflation Expectations (Jul) | Medium | |

Michigan Consumer Expectations (Jul) | High | |

Michigan Consumer Sentiment (Jul) | High | |

Michigan Current Conditions (Jul) | High | |

13:00 | ||

WASDE Report | Medium |

There are important inflation and unemployment data throughout the week, so the market could move quite a bit next week. It’s essential to stay alert.

Weekly technical analysis

Some Interesting Assets [Stocks and Cryptos]

It was a great week, with some assets like TSLA and JMIA yielding an 18% return, and others like AMD and NVDA returning a bit less. For now, I’m proceeding with more caution given the current volume profile.

TSLA

TESLA fulfilled our expectations, moving towards the upper line of the descending channel and even breaking the trend line, giving us an 18% return in 2-3 days. It was a beautiful trade. Now we just need to wait for it to settle.

TSLA 1D

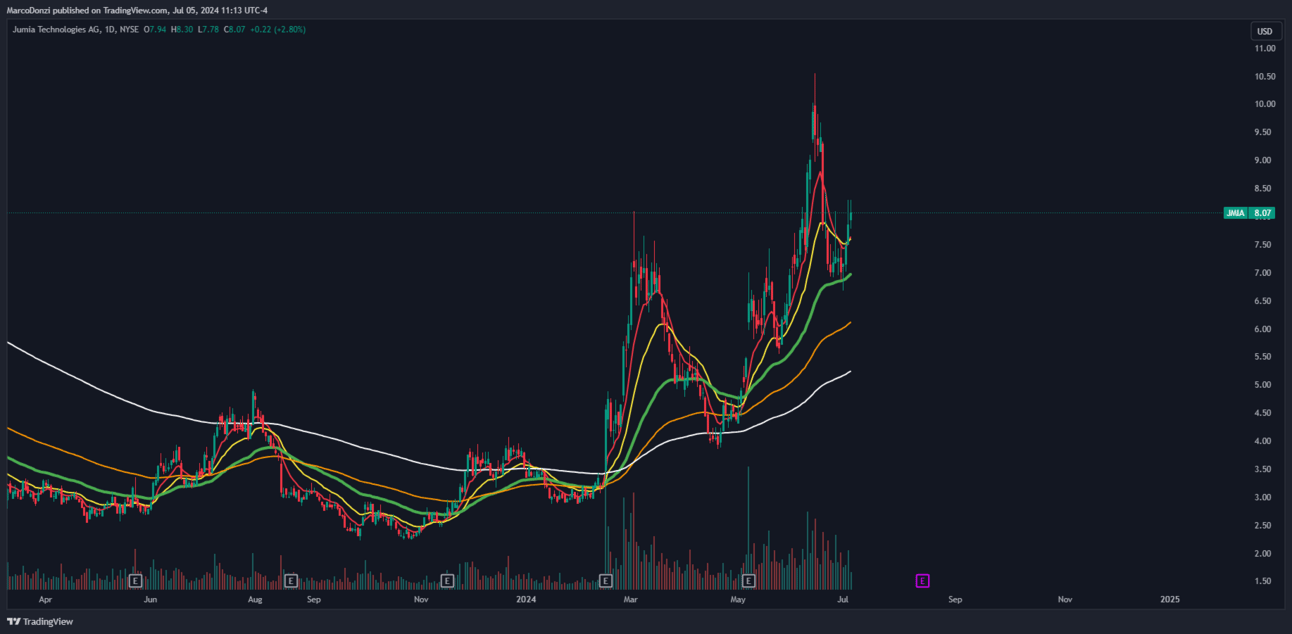

JMIA

JMIA was also mentioned last week as looking very good on the daily chart. Here are both charts; it also achieved an 18% return in a week. I hope someone was able to take advantage of it.

$JMIA 1D - last week

$JMIA 1D - today

NVDA

NVDA is a bit more constrained in this rebound, and it's rising with declining volume. For now, I’m watching from the sidelines. It’s possible that if it breaks a specific price level, volume could start to come in, but for now, I'm keeping a close eye on it from outside.

$NVDA 1D

AMD

We discussed last week that the entry point at $144 for AMD yielded very good results. It’s now continuing to rise, currently valued at $170. That's nearly an 18% gain in about 2.5 months—still a solid return!

$AMD 1W

Which stock/crypto should we analyze next week?

Tech Stocks

I generally like tech stocks, but I want to see more volume behavior before making any moves. I’m watching closely from the sidelines until I see some type of confirmation with the volume. Right now, many are recovering but with declining volume. It’s possible that once they hit a certain price, they could start gaining volume and rise, but if the volume doesn’t come in, they could deflate as well. That’s why I’m not entering all of them.

Random

Random fact of the week

Did you know that dragonflies can fly backward? These amazing creatures have the ability to fly in any direction, including backward, thanks to their four wings that can move independently.

Art

Ilustration of the week

If you enjoyed the content and think it could be useful to someone you know, feel free to share this newsletter with the button below, and help us grow our community! :)

Disclaimer: This is not an investment recommendation. All information is provided for entertainment purposes only.