The markets are on fire this week, with Chinese stocks skyrocketing by 28% thanks to a major government stimulus package. Investors are scrambling to take advantage of the momentum, but it’s not just China making waves. Gold ETFs are up over 30% YTD, while copper has broken past the $10,000 per ton mark for the first time in months. Meanwhile, oil is surging due to the escalating tensions between Iran and Israel, which threaten to disrupt nearly one-third of the global oil supply. All of this is happening while inflation dips to 2.2%.

MOTIVATION

QUOTE OF THE WEEK

"The only limit to our realization of tomorrow is our doubts of today."

— Franklin D. Roosevelt

This quote reminds us that our future is built on the foundation of the belief we have in ourselves today. It's a message of hope and action for those looking to create a better tomorrow.

WEEK 30/09/2024 to 04/10/2024

🚨What you need to know this week🚨

Chinese stocks surge on stimulus package: Chinese equities have jumped over 20%, with the CSI300 gaining a massive 28% in just two weeks, driven by government stimulus.

Inflation drops to 2.2% in August: The lowest level since February 2021, easing fears of long-term price pressure.

Gold ETFs up more than 30% YTD: Gold has benefited from record highs, boosted by a weaker dollar and supply limitations in silver, which is also seeing price increases.

Copper crosses $10,000 per ton: For the first time in three months, copper has surged above $10,000 per ton, highlighting the strength of the commodities market.

Utilities and real estate benefit from rate cuts: As anticipated in previous newsletters, these sectors are positioning as winners in the current rate-cut environment.

Trade tariffs and taxes could delay GDP: The combination of Trump’s high tariffs and Kamala’s proposed high corporate taxes could slow economic growth and bring inflation back.

Powell signals more rate cuts ahead: Two more 0.25% cuts are expected this year, while further 0.5% cuts seem unlikely.

Potential impact of dockworkers' strike: If the strike drags on, consider doing your holiday shopping early. A prolonged strike could dent U.S. GDP and push inflation higher.

Strike ends with 60% wage increase over six years: The deal was struck after lengthy negotiations, averting further economic disruption.

Oil prices surge amid geopolitical tensions: Rebel attacks in the Red Sea and rising tensions between Iran and Israel are pushing oil prices higher. The region accounts for one-third of the global oil supply.

Strong labor report: September saw 254,000 new jobs added, exceeding expectations of 150,000. Unemployment fell to 4.1%, which could influence future rate cuts.

Middle-class wages haven't kept pace with productivity: According to the Economic Policy Institute, productivity rose 80% from 1979 to 2024, while wages for the middle class increased just 29.4%.

EU imposes 45% tariffs on Chinese EVs: The European Union has introduced tariffs of up to 45% on electric vehicles (EVs) from China, which will be in place for the next five years.

04/10/2024

🔎 Insights on the market 🔎

This week was quite interesting, with momentum in commodities and Chinese stocks. Then, with a strong labor report, it ended up being a bullish week after some uncertainty in the first few days.

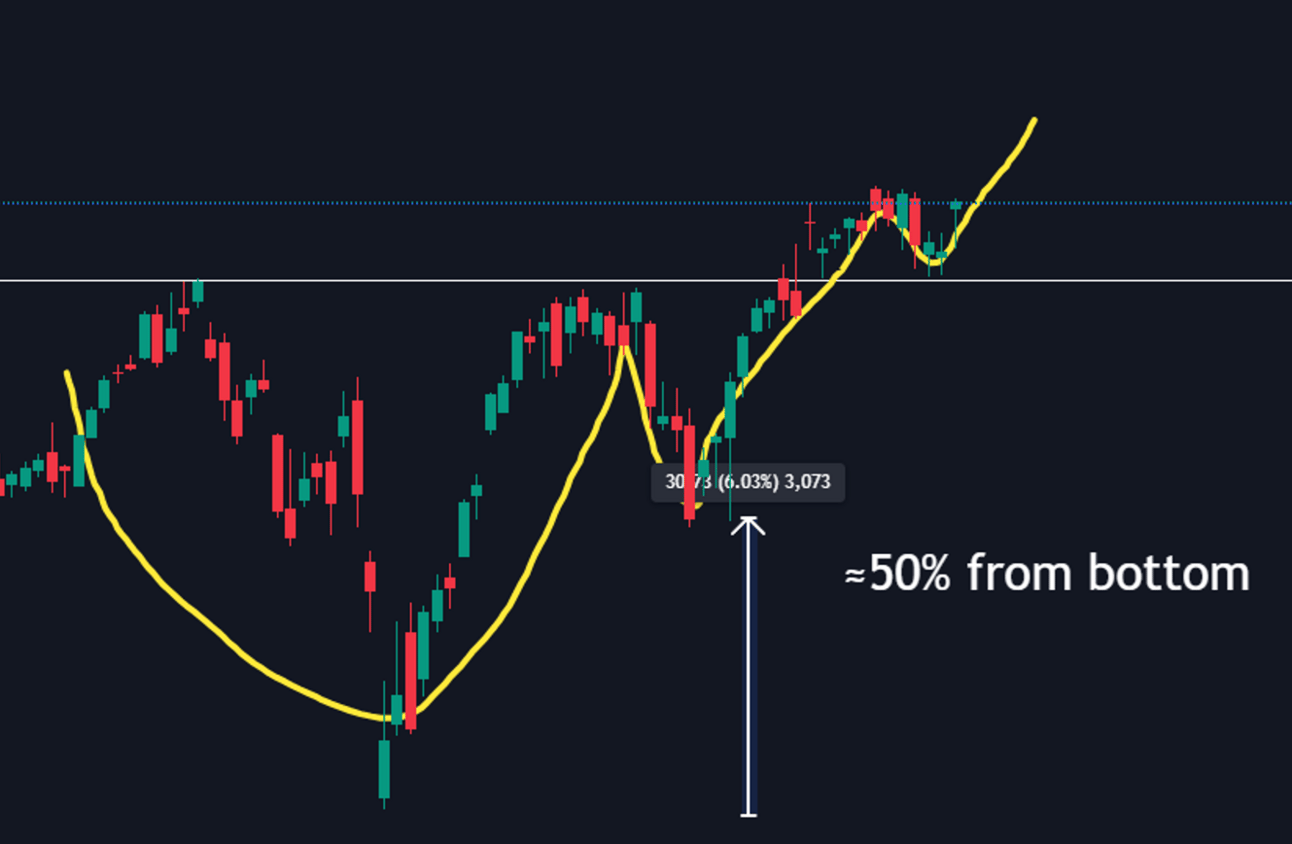

Now, more 25bp rate cuts are expected before the end of the year, and we have SPY near its highs, with what appears to be a cup and handle pattern as shown in the chart below. If this pattern confirms, the price dip we saw this week could have been an excellent buying opportunity for those who took advantage of it. Personally, I’m in about five assets that are already giving me a good return, including a couple of oil companies to capitalize on the rise in oil from its lows, and others like AMZN and OMF, which were in an interesting buying zone.

Let’s see how the market unfolds next week. For now, the candle left behind looks promising.

SPY 1D CHART

📜 Historical Perspective 📜

Commodities surge: The last time copper passed $10,000 per ton was back in 2011, during a similar global recovery phase. Commodities, particularly gold, are often seen as inflation hedges, which is critical during uncertain economic times.

Strikes and inflation: The dockworkers' strike, if prolonged, could lead to supply chain issues similar to those seen during the 2021 pandemic, when inflation surged as goods became harder to come by.

28/09/2024

✍️Market Lessons ✍️

This week teaches that geopolitical tensions and labor movements remain powerful forces that can influence global markets and commodity prices. Keeping a close eye on these factors, alongside rate cut signals from the Fed, is key to navigating the near future.

💸 Common Mistakes 💸

Overlooking the impact of trade tariffs and labor strikes on GDP and inflation can be costly. Investors who ignore the economic ripple effects of these events may miss key market signals, especially in the commodities and manufacturing sectors

If you're not subscribed to receive these emails weekly and completely free, you can do so with the button below:

📅Next Week’s Economic Calendar (07/10 to 11/10):📅

Monday, October 7, 2024

Time (EST) | Event | Forecast | Previous |

|---|---|---|---|

14:50 | FOMC Member Kashkari Speaks | - | - |

19:00 | FOMC Member Bostic Speaks | - | - |

Tuesday, October 8, 2024

Time (EST) | Event | Forecast | Previous |

|---|---|---|---|

11:30 | Atlanta Fed GDPNow (Q3) | 2.5% | 2.5% |

13:45 | FOMC Member Bostic Speaks | - | - |

14:00 | 3-Year Note Auction | - | 3.440% |

Wednesday, October 9, 2024

Time (EST) | Event | Forecast | Previous |

|---|---|---|---|

09:00 | FOMC Member Bostic Speaks | - | - |

13:00 | Atlanta Fed GDPNow (Q3) | - | - |

15:00 | FOMC Meeting Minutes | - | - |

19:00 | FOMC Member Daly Speaks | - | - |

Thursday, October 10, 2024

Time (EST) | Event | Forecast | Previous |

|---|---|---|---|

09:30 | Continuing Jobless Claims | - | 1,826K |

09:30 | Core CPI (MoM) (Sep) | 0.2% | 0.3% |

09:30 | Core CPI (YoY) (Sep) | - | 3.2% |

09:30 | CPI (MoM) (Sep) | 0.1% | 0.2% |

09:30 | CPI (YoY) (Sep) | 2.3% | 2.5% |

09:30 | Initial Jobless Claims | - | 225K |

12:00 | FOMC Member Williams Speaks | - | - |

15:00 | Federal Budget Balance (Sep) | - | -380.0B |

17:30 | Fed's Balance Sheet | - | 7,047B |

Friday, October 11, 2024

Time (EST) | Event | Forecast | Previous |

|---|---|---|---|

09:30 | Core PPI (MoM) (Sep) | 0.2% | 0.3% |

09:30 | PPI (MoM) (Sep) | 0.1% | 0.2% |

11:00 | Michigan 1-Year Inflation Expectations (Oct) | - | 2.7% |

11:00 | Michigan 5-Year Inflation Expectations (Oct) | - | 3.1% |

11:00 | Michigan Consumer Expectations (Oct) | - | 74.4 |

11:00 | Michigan Consumer Sentiment (Oct) | 70.2 | 70.1 |

14:00 | U.S. Baker Hughes Oil Rig Count | - | - |

14:00 | U.S. Baker Hughes Total Rig Count | - | - |

14:10 | FOMC Member Bowman Speaks | - | - |

📅EARNINGS CALENDAR (08/10-11/10/2024)📅

Tuesday, October 8, 2024

Company | EPS Forecast | Revenue Forecast | Market Cap |

|---|---|---|---|

PepsiCo (PEP) | 2.31 | 23.98B | 230.68B |

Thursday, October 10, 2024

Company | EPS Forecast | Revenue Forecast | Market Cap |

|---|---|---|---|

Progressive (PGR) | 3.49 | 19B | 149.73B |

Delta Air Lines (DAL) | 1.54 | 14.67B | 31.58B |

Domino’s Pizza Inc (DPZ) | 3.6 | 1.1B | 14.82B |

Friday, October 11, 2024

Company | EPS Forecast | Revenue Forecast | Market Cap |

|---|---|---|---|

JPMorgan (JPM) | 4.00 | 41.51B | 600.96B |

Wells Fargo & Co (WFC) | 1.28 | 20.4B | 193.74B |

Bank of NY Mellon (BK) | 1.38 | 4.5B | 53.10B |

Fastenal (FAST) | 0.5136 | 1.91B | 40.19B |

Summary of the Week’s Summary

This week started off bearish, giving the impression of a correction, but with the data that emerged, the price dip turned out to be a good buying opportunity. Now, we’re starting next week near a previous high, with what looks like a cup and handle pattern that could offer an interesting gain for those who entered during the small correction in the first few days of this week. To see my daily stock analysis, you can follow me on my X profile.

The ongoing geopolitical tensions in the Middle East and the rising oil prices pose risks to both inflation and the global energy supply. With one-third of the world’s oil supply coming from the region, any escalation could drive further market volatility.

If you're not subscribed to receive these emails weekly and completely free, you can do so with the button below:

🤑 Opportunity Map 🤑

Chinese stocks rally: With the Chinese government's stimulus package boosting equities, investors might find opportunities in Chinese ETFs or tech companies. The CSI300’s 28% jump in two weeks highlights the potential for short-term gains in this region.

Gold and silver's strong performance: Gold ETFs are up over 30% YTD, benefiting from record-high gold prices and a weaker dollar. Silver, constrained by supply issues, is also rising. Investors can explore gold and silver ETFs or commodity-related stocks to ride this momentum.

Oil price surge amid geopolitical tensions: With the Red Sea under threat from rebel attacks and rising tensions between Iran and Israel, oil prices have surged. The region supplies one-third of the world’s oil, making energy stocks and oil-related ETFs potential opportunities.

Art

Illustration of the Week

If you enjoyed the content and think it could be useful to someone you know, you can share this newsletter with the button below, and help us grow :)

Disclaimer: This is not investment advice. All the information is provided for entertainment purposes only.