MOTIVATION

Quote of the week

"Success is the sum of small efforts repeated day in and day out."

-Robert Collier-

I'm sharing some photos from my business trip to China, Germany, and France, which is why I didn't publish for 2 weeks.

Shanghai

Shanghai, incredible architecture.

Bavaria, very similar to Argentine Patagonia.

Paris, always beautiful

Week of 24/06/2024

What You Need to Know This Week

The last week of June, Q2, and H1 2024 has come to an end.

Home sales in the U.S. have fallen for the third consecutive month, yet prices are at record highs, indicating a growing wealth gap.

The first presidential debate is approaching, with crypto and inflation as central themes of this race.

Russell 2000 (small-cap) stocks performed poorly.

Nasdaq and Dow Jones are moving in opposite directions.

FedEx, considered an economic indicator (due to freight), posted good results and rose 15% after its report.

VanEck is seeking to launch an ETH ETF to start trading on July 2, and is also looking into a SOLANA ETF.

The SP500 has performed very well for an election year, historically not seeing good performance during such years.

The VIX is low, indicating little concern for the coming months; on average, the VIX rises by 25% from July to November in an election year.

Bullish drivers include earnings growth, declining inflation, and significant investment in AI, though valuations are high.

The yen is at its lowest value since 1986, with rumors of intervention by Japanese authorities.

A favorable reading of the PCE could signal a potential rate cut in September, with the PCE at 0.1% in May and 2.6% YoY, the lowest since March 2021.

Some anticipate worse PCE numbers in the near future due to high transportation and housing costs.

Crypto losses due to hacks and rug pulls doubled to $572 million in Q2 2024.

If you’re not subscribed to receive these emails weekly and completely free, you can do so with the button below:

ECONOMIC CALENDAR 01/07/2024

Economic Events

Time (NY) | Event | Influence |

|---|---|---|

Sunday | 10:00 | |

Speech by FOMC Member Williams | High | |

Monday | 10:45 | |

S&P Global US Manufacturing PMI (Jun) | Medium | |

11:00 | ||

Construction Spending (MoM) (May) | Medium | |

ISM Manufacturing Employment (Jun) | High | |

ISM Manufacturing New Orders (Jun) | High | |

ISM Manufacturing PMI (Jun) | High | |

ISM Manufacturing Prices (Jun) | High | |

Tuesday | 09:55 | |

Redbook (YoY) | Medium | |

10:30 | ||

Speech by Fed Chair Powell | High | |

11:00 | ||

JOLTs Job Openings (May) | High | |

IBD/TIPP Economic Optimism | Medium | |

17:30 | ||

Weekly Crude Oil Inventories (API) | High | |

Wednesday | All Day | |

Holiday: U.S. Independence Day (early close at 13:00) | Low | |

08:00 | ||

30-Year Mortgage Rate MBA | Medium | |

Mortgage Applications MBA (WoW) | Medium | |

08:30 | ||

Challenger Job Cuts (Jun) | Medium | |

09:15 | ||

ADP Nonfarm Employment Change (Jun) | High | |

09:30 | ||

Continuing Jobless Claims | High | |

Initial Jobless Claims | High | |

Trade Balance (May) | High | |

10:45 | ||

S&P Global Composite PMI (Jun) | Medium | |

S&P Global Services PMI (Jun) | Medium | |

11:00 | ||

Factory Orders Ex Defense (MoM) (May) | Medium | |

Factory Orders Ex Transportation (MoM) (May) | Medium | |

ISM Non-Manufacturing Business Activity (Jun) | Medium | |

ISM Non-Manufacturing Employment (Jun) | Medium | |

ISM Non-Manufacturing New Orders (Jun) | Medium | |

ISM Non-Manufacturing PMI (Jun) | High | |

ISM Non-Manufacturing Prices (Jun) | Medium | |

15:00 | ||

FOMC Meeting Minutes | High | |

Thursday | All Day | |

Holiday: U.S. Independence Day | Low | |

Friday | 09:30 | |

Average Hourly Earnings (YoY) (Jun) | High | |

Average Hourly Earnings (MoM) (Jun) | High | |

Average Weekly Hours (Jun) | High | |

Government Payrolls (Jun) | Medium | |

Manufacturing Payrolls (Jun) | Medium | |

Nonfarm Payrolls (Jun) | High | |

Participation Rate (Jun) | Medium | |

Private Nonfarm Payrolls (Jun) | High | |

U6 Unemployment Rate (Jun) | High | |

Unemployment Rate (Jun) | High | |

17:30 | ||

Fed Balance Sheet | Medium |

There are several important data points next week, including manufacturing data, job openings, unemployment claims, FOMC minutes, and hourly earnings.

Be aware that these events can move the market in any direction, and H2 2024 is starting.

WEEKLY TECHNICAL ANALYSIS

Some Interesting Assets [Stocks and Cryptos]

As we ease back into things after the trip, let’s take a look at some interesting stocks and cryptos. We’ll likely gain more clarity next week.

TSLA

TESLA is at a key zone; if it breaks, it could continue toward the upper line of a descending channel, as shown in the image.

TSLA 1D

JMIA

JMIA is in an interesting buying zone. It's a much riskier and more volatile play, but overall, it looks good on the daily chart.

$JMIA 1D

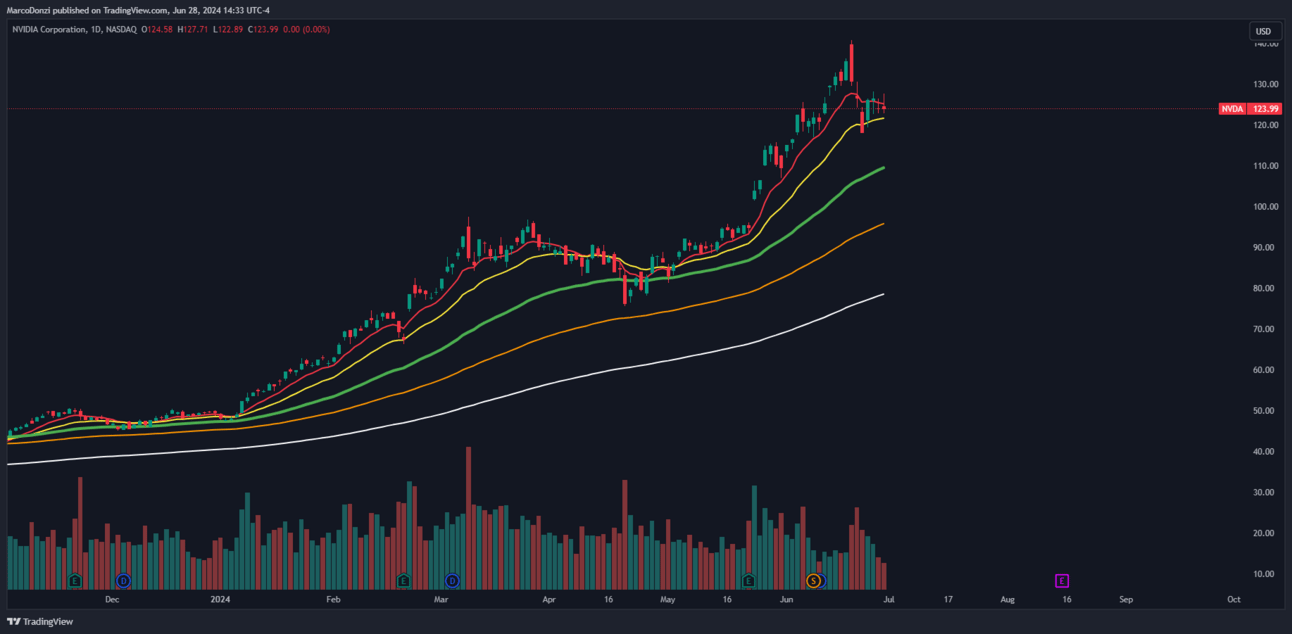

NVDA

NVDA is another stock that provides interesting buying zones every time it corrects. It has been very bullish this year and may offer opportunities as it pulls back, so there’s no need to rush.

$NVDA 1D

AMD

AMD provided a great entry point around the $144 mark. I’m in and following it closely; so far, it’s looking very positive.

$AMD 1W

SOL-USDT

SOLANA is another interesting asset this year. It has good potential, and if an ETF actually comes out, it could generate even more momentum.

$SOL-USDT 1D

Which stock/crypto should we analyze next week?

Next week, I'll decide what to analyze because, for now, I don't see anything that excites me too much. I'll stay alert, and I’ll likely post something interesting on https://x.com/profitustrader if I spot anything noteworthy. You can follow me there!

Random

Random fact of the week

Did you know that octopuses have three hearts? Two hearts pump blood to the gills, while the third heart pumps blood to the rest of the body. This fascinating fact reflects the complexity and adaptability of these incredible marine animals.

Art

Ilustration of the week

If you enjoyed the content and think it could be useful to someone you know, feel free to share this newsletter with the button below, and help us grow our community! :)

Disclaimer: This is not an investment recommendation. All information is provided for entertainment purposes only.