Are Lithium Miners Still a Good Opportunity?

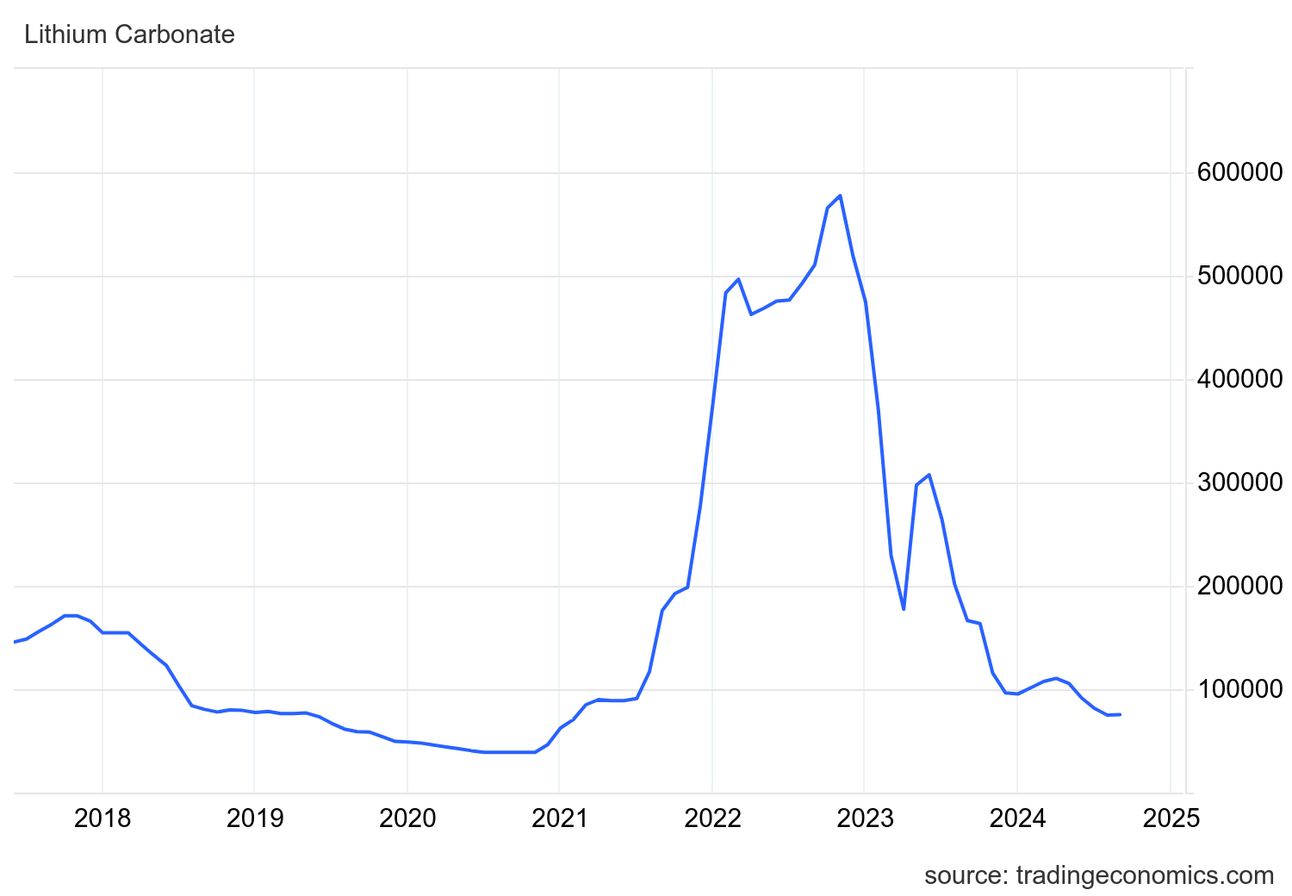

We all remember the lithium price boom in 2023—it hit a jaw-dropping peak of 600,000 CNY per tonne (around USD 85k/tonne). But fast forward to today, and we’re seeing prices below USD 10k per tonne. So, what happened, and are lithium miners still worth looking at?

Take a look at the lithium price evolution over the past few years, and you’ll see the story unfold. Peaks followed by sharp declines.

The Rise and Fall of Lithium Prices

The initial price surge was driven largely by the massive demand for electric vehicles (EVs) and electronics. Everyone thought lithium was a golden opportunity. Miners started ramping up production and expanding capacity to meet what seemed like insatiable demand. But that rapid expansion created a supply glut.

Then came the slowdown. EV sales have been lower than expected, which caused demand to drop. On top of that, battery recycling has started to take off, and China—the largest consumer of lithium for battery production—has been adjusting its inventories. There’s also the looming promise of solid-state batteries, which could reduce lithium’s dominance in the market. All of these factors have made manufacturers hesitant to lock into long-term contracts.

Let’s take a look at the risk and opportunities here:

The Good

Ambitious emissions targets: Many countries are pushing for cleaner energy and have set dates to phase out internal combustion engines.

Renewable energy: Large-scale energy storage is needed for renewable projects, which drives lithium demand.

Government incentives: Tax breaks and policies are being implemented to promote lithium use.

Potential for a price rebound: If no new technology replaces lithium in the short term, demand could rise again, pushing prices up.

The Bad

Oversupply: Miners expanded too quickly, leading to a supply glut.

Weaker than expected EV sales: Lower demand for EVs has reduced lithium needs.

Battery recycling: Improved recycling technologies are reducing the need for new lithium production.

China’s inventory adjustments: The largest consumer of lithium has been adjusting stockpiles, affecting demand.

New technologies: Solid-state batteries and other advancements could lessen lithium's role in the future.

Lithium Miners: Opportunity or Falling Knife?

Right now, many lithium miners are trading at historic lows. This could present a real opportunity—but with a word of caution. We don’t want to catch a falling knife. Timing is key here, and investors should approach this with care, weighing the risks of further price drops against the potential for a rebound.

Let’s take a look at some ticker symbols of lithium miners.

Albemarle Corporation (ALB)

Global U.S. company, a leader in lithium production and refining for batteries.

ALB WEEKLY CHART

Sociedad Química y Minera de Chile (SQM)

Chilean company, one of the largest lithium producers globally.

SQM WEEKLY CHART

Piedmont Lithium (PLL)

U.S.-based company in expansion, with a strategic agreement with Tesla.

PLL WEEKLY CHART

Ganfeng Lithium (GNENF)

Chinese producer, one of the world’s largest, also a battery manufacturer.

GNENF WEEKLY CHART

Lithium Americas Corp (LAC)

Company with key projects in Argentina and the U.S.

LAC WEEKLY CHART

As we can see, almost all of them are at historic lows, but nothing says that something that has fallen a lot can't keep falling, so caution is advised.

Disclaimer: This is not investment advice. All the information is provided for entertainment purposes only.

If you enjoyed the content and think it could be useful to someone you know, you can share this newsletter with the button below, and help us grow :