MOTIVATION

Quote of the week

"Don't measure your wealth by the money you have, but by the things you wouldn't change for money."

-Paulo Coelho-

Week of 20/05/2024

What You Need to Know This Week

The market is expecting rate cuts of up to 50 basis points by the end of the year, which seems overly optimistic given the current data.

China is reinforcing its gold reserves, which now represent nearly 5% of its official reserves—50% more than at the beginning of 2020.

NVDA reported very strong results, breaking not only the psychological resistance of $1,000 but surpassing it.

If the bull market were to end here, it would be the shortest bull market in history at only 18 months, so statistically, that leans towards a bullish sentiment.

Gold has reached historic highs, and copper is rising due to supply cuts.

Waller from the FED indicated that he doesn’t see the need for further rate hikes, emphasizing that inflation is stabilizing.

Currently, we face: high inflation, high interest rates (making loans more expensive), and rising fuel costs, which could lead to reduced consumer spending and, in turn, lower inflation.

U.S. policy is beginning to engage with the crypto world ahead of the presidential elections, seemingly out of fear of losing pro-crypto voters.

The SEC has approved the ETH ETF. ETH represents 18% of the crypto market cap.

The FED warns about asset valuations once adjusted for risk, noting that this is occurring cross-sectorally—not just in tech, for example.

As we can see, there are mixed messages. What we do know is that even the slightest positive news leads to market rallies, while negative news causes pullbacks, resulting in high volatility.

We need to stay alert to news and data, and this election year could provide a tailwind for the crypto world if it receives support/approval from both parties.

Clearly, this year seems to be dominated by the election cycle and the timing of potential rate cuts (and the indications that macro data may provide).

If you’re not subscribed to receive these emails weekly and completely free, you can do so with the button below:

ECONOMIC CALENDAR 27/05/2024

Economic Events

Time (NY) | Event | Influence |

|---|---|---|

Monday | All Day | |

Holiday: Memorial Day in the U.S. | Low | |

14:45 | ||

Speech by FOMC Member Williams | High | |

Tuesday | 01:55 | |

Speech by FOMC Member Bowman | High | |

Speech by FOMC Member Mester | High | |

10:00 | ||

Housing Price Index (YoY) (Mar) | Medium | |

Housing Price Index (MoM) (Mar) | Medium | |

Housing Price Index (Mar) | Medium | |

S&P/CS Composite HPI - 20 s.a. (MoM) (Mar) | Medium | |

S&P/CS Composite HPI - 20 n.s.a. (MoM) (Mar) | Medium | |

S&P/CS Composite HPI - 20 n.s.a. (YoY) (Mar) | Medium | |

10:55 | ||

Speech by FOMC Member Kashkari | High | |

11:00 | ||

Consumer Confidence CB (May) | High | |

14:05 | ||

Speech by Fed Governor Cook | High | |

Wednesday | 11:00 | |

Richmond Manufacturing Index (May) | Medium | |

Richmond Manufacturing Shipments (May) | Medium | |

Richmond Services Index (May) | Medium | |

14:45 | ||

Speech by FOMC Member Williams | High | |

15:00 | ||

Beige Book | High | |

17:30 | ||

Weekly Crude Oil Inventories (API) | High | |

Thursday | 09:30 | |

Initial Jobless Claims | High | |

Core PCE Prices (Q1) | High | |

Corporate Profits (QoQ) (Q1) | High | |

GDP (QoQ) (Q1) | High | |

GDP Price Index (QoQ) (Q1) | High | |

GDP Sales (Q1) | High | |

Trade Balance of Goods (Apr) | Medium | |

Continuing Jobless Claims | High | |

11:00 | ||

Pending Home Sales (MoM) (Apr) | Medium | |

Pending Home Sales Index (Apr) | Medium | |

Friday | 09:30 | |

Core PCE Price Index (MoM) (Apr) | High | |

Core PCE Price Index (YoY) (Apr) | High | |

Personal Income (MoM) (Apr) | High | |

Personal Spending (MoM) (Apr) | High | |

Real Personal Consumption (MoM) (Apr) | High | |

10:45 | ||

Chicago PMI (May) | Medium | |

11:30 | ||

Atlanta Fed GDPNow (Q2) | Medium |

As we can see, we need to pay attention to the speeches from FOMC members.

The housing price index can provide insights into inflation.

Thursday will be an interesting day with unemployment indices, core prices, GDP, and spending.

Stay alert during these moments, and remember to convert NY time to your local time.

Weekly technical analysis

Some Interesting Assets [Stocks and Cryptos]

We’re entering a week near the highs of the indices (SPX, QQQ), so I’ll be cautious and not risk too much, as the outcome could go either way.

DKNG

“DraftKings has been in an interesting bullish channel for quite some time, indicating that the $40 area is attractive. The weekly chart looks good, and the next resistance is around the $50 zone marked a few weeks ago.”

This was what we wrote for the week of 05/20/2024.

Now DKNG is at the $40 area and has rebounded strongly after touching the support zone near $39.27. It still remains within this loaded range (red rectangle). I see it as an attractive entry point, but if it falls below this range, I wouldn’t wait because there’s a potential 10% drop if it loses that support down to the next support zone around $35-36.

DKNG 1D

ETH-USDT

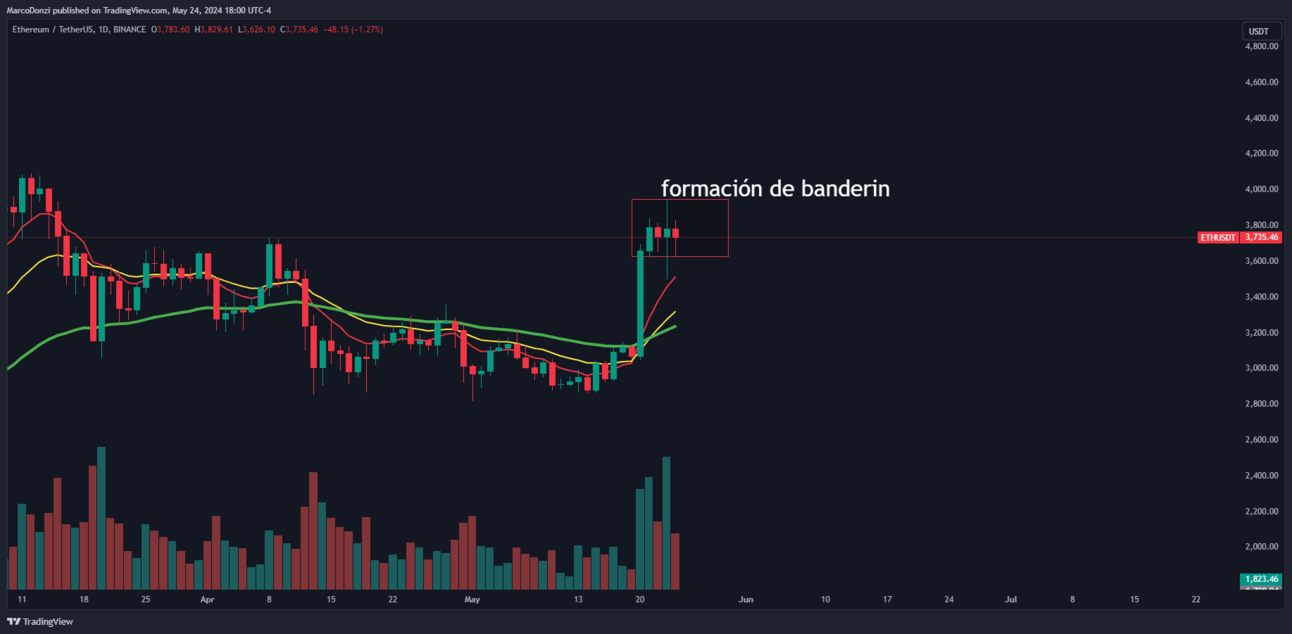

Last week, we mentioned that Ethereum would look attractive for entry if it touched the 20-week rejection zone again, and it did. This candle yielded a 20% gain in one week before rejecting at the $3,978 zone, which is a clear resistance.

For now, I’m waiting to see how this pennant formation develops on the daily chart. With the approval of the ETH ETFs, there could be a strong influx of capital, but we need to be cautious of overbought conditions.

$ETH-USDT 1W

$ETH-USDT 1D

YPF

We mentioned last week that it looked interesting around the $21 area, which is exactly where it is now. However, it's dropping quite strongly, so I won't be entering just yet; I want to see it find a bit more support. For now, I’m watching from the sidelines. The $18-19 range looks interesting.

YPF

DLX

Deluxe Corp has quite bullish projections from analysts, and it’s currently at a support zone, making it attractive to me.

The only thing to keep in mind is that on the weekly chart, it’s a bit distant from the more attractive entry zones, but on the daily chart, it looks good. A DCA (Dollar Cost Average) strategy could be interesting, but each individual should conduct their own analysis. The price target I see from analysts ranges from $27 to $35.

In the weekly chart, I’ve also marked interesting zones to watch for reactions.

$DLX 1D

$DLX 1W

Qué acción/cripto analizamos semana que viene?

BABA

Currently around $81.20, it’s in a pullback after a strong upward movement. From the last swing, it’s bouncing right at the 0.5 Fibonacci retracement level and has an interesting support zone. The next nearby support is around $77.92. I’ll be watching it closely. There was very good volume on Friday, and it feels like if nothing unusual happens in the macro environment, it could have upward momentum.

SPX

For now, it continues to consolidate laterally, but I’m not fully convinced until I see more macro data. On the other hand, several important assets are close to their highs, and I’m not particularly impressed by the strength they’re showing. I want to wait for more macro data next week and see how it reacts before making general decisions. But of course, each person ultimately decides for themselves.

AMD

Last week, I made a 10% profit in 5 days, and I mentioned that I would wait for a rebound during this pullback. It now seems to be experiencing that rebound, so it looks interesting to monitor next week. I’ll be keeping a close eye on it in case an entry opportunity arises.

Random

Random fact of the week

Did you know that in Switzerland it is illegal to own only one guinea pig? This is because guinea pigs are social animals and can suffer from loneliness, so the law requires that you always have at least two to ensure their well-being.

Art

Ilustration of the week

If you enjoyed the content and think it could be useful to someone you know, feel free to share this newsletter with the button below, and help us grow our community! :)

Disclaimer: This is not an investment recommendation. All information is provided for entertainment purposes only.