04/02/2025

🔎 Insights on the market 🔎

These last few days have been marked by a very peculiar movement—high volatility due to uncertainty, yet with VERY easy trades to execute.

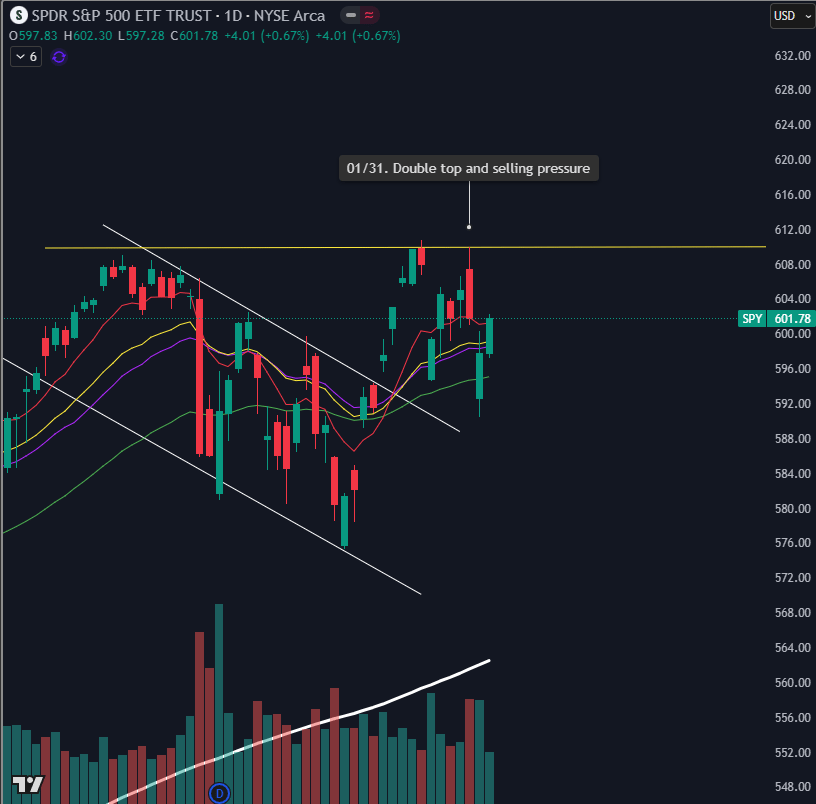

On January 31st, the $SPY formed a double top at $610, and that same day, it experienced a strong price drop. But even worse was the following day...

$SPY daily chart

The following day was the most interesting and the one that offered the best opportunities. Why? Not only did it open with a significant gap up, but it also dropped to a low of $590, which was a clear buy.

Why do I say this? Because the entire drop was driven by fear over interest rates… but it was obviously just panic, and some sort of agreement or easing between countries was bound to happen to keep negotiations going.

$SPY daily chart

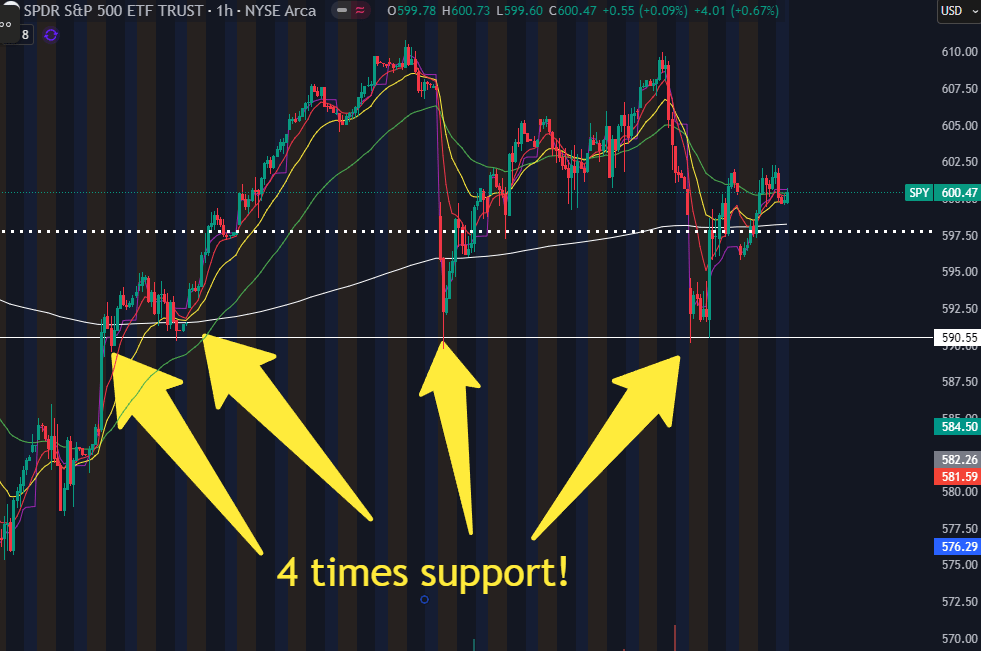

If you ask me where the clear buying point was, I'll tell you—it might not look obvious on the daily chart, but on the hourly chart, it's crystal clear. Let me show you.

$SPY hourly

What you see shaded in brown and blue represents the pre-market and after-hours movements. If you look at the hourly chart, the $590 zone was a clearly defined area for a potential strong rebound. And without going too far, just look at how it bounced from there...

$SPY hourly huge bounce on $590

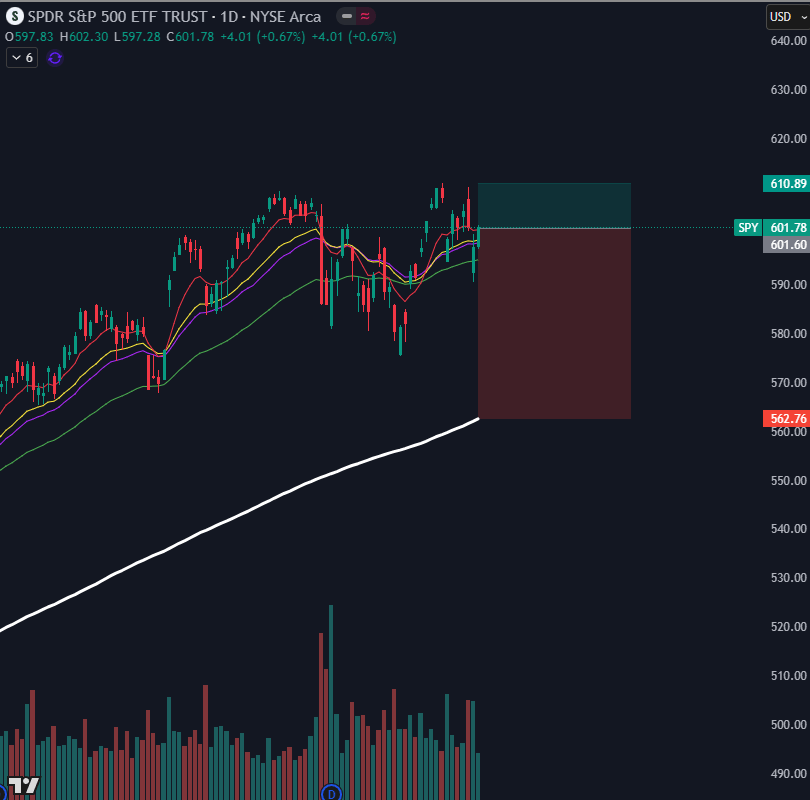

Now the gap has been closed, and the situation is more difficult to determine. The gap left on daily chart on February 3rd, from $601 to $590, has been filled.

What’s my opinion?

On one hand, volatility can be scary… but it also creates opportunities. Whether to the upside or downside, there are ways to take advantage of it.

Now, if the question is whether we continue the uptrend or not, the key levels to watch are: breaking above $610 to confirm upside momentum and holding above $560 to avoid a deeper drop. This gives us a range from today’s price of $601, with a 6.8% downside and less than 1.5% upside.

With that in mind, you can decide how you feel about going long or short and at what levels. Personally, I’ve been long since $580 in my last swing trade. I sold half my position at $608 on Friday to lock in profits, then rebought that half at $590 and sold it again at $600. I’m still holding my original half, which has gained nicely from these swings.

$SPY daily chart

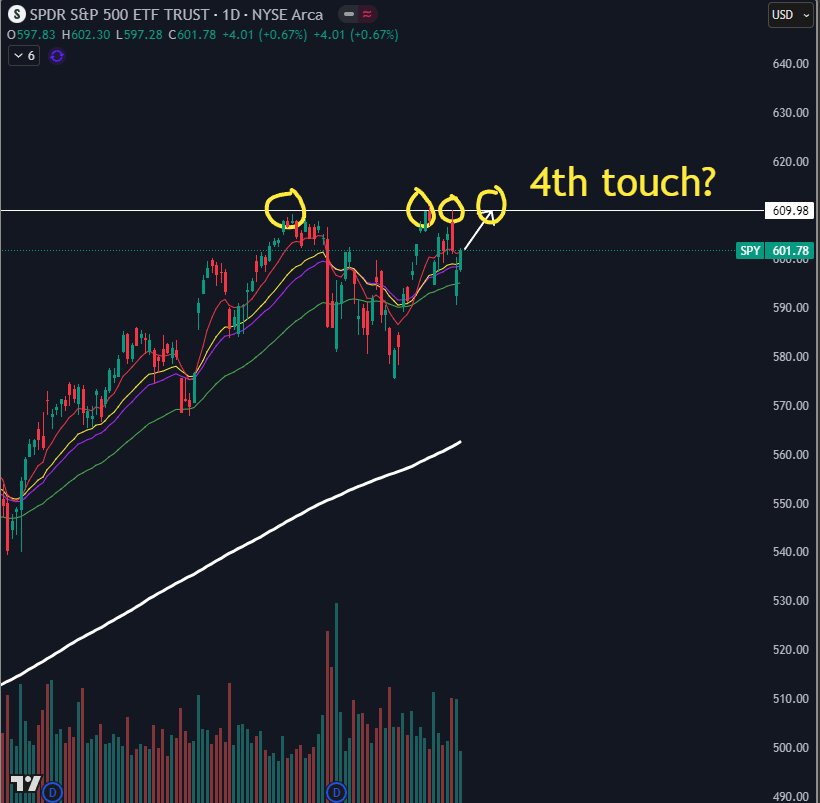

One thing I do see—if we test $610 again, I think there’s a high probability it breaks to the upside, as it would be the fourth time testing that level. If it doesn’t break, I’ll sell everything and wait for a lower entry.

$SPY daily chart

That's what I think, and I hope my comments in this newsletter are useful for your analysis. Do whatever you believe is best for your strategy.

If you liked it, share it—it helps me grow this newsletter!

If you're not subscribed to receive these emails weekly and completely free, you can do so with the button below:

If you're not subscribed to receive these emails weekly and completely free, you can do so with the button below:

If you enjoyed the content and think it could be useful to someone you know, you can share this newsletter with the button below, and help us grow :)

Disclaimer: This is not investment advice. All the information is provided for entertainment purposes only.